Addition to the new H&M position with a purchase of additional 40 shares for 286,10 SEK per share. This brings the total to 70 shares. It remains to be seen if I’ll make a third purchase anytime soon. Next purchase should be from the US if I can find something with suitable valuation.

Month: April 2016

Recent Buy: Hennes & Mauritz AB (B Series)

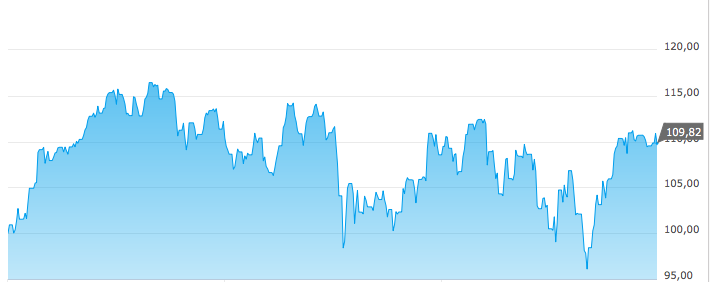

Official purchase of the month. Hennes & Mauritz has been in and out of my broader watch list. It has always had plenty going for it. Yet it never really has fit the bill for me. In general I like established global top brands which are able to generate plenty of cash year after year. However some business areas have been problematic for me. Clothing and fashion is one of them. Airlines and carmakers are also in the same list.

Now things changed a little bit as I opened a small position in Hennes & Mauritz with a purchase of 30 shares for 295,30 SEK per share. The real tipping point this time was the insider activity. I’ll consider doubling the position next month. One benefit is that this is the first position that will produce distributions in SEK (my other Swedish positions are actually double listed in Helsinki and therefore the distributions are automatically converted to EUR). I generally prefer to have income in multiple currencies and SEK will be the fourth following EUR, USD and NOK.

Links: H&M Investor Relations, Insider activity: Stefan Persson

Recent Buy: Fortum Corporation and Nordea Bank

Slight change in plans. I was planning to buy back all the Fortum shares I sold recently. I was hoping to do that around 10,80 EUR per share during the next six to nine months or so. Instead I decided to change my allocation a little bit. I still have a bit mixed feelings about Fortum. On the other hand there’s the political risk which in my opinion is the worst kind of risk for any stock. Then there’s Nordea which has been hit lately because of the so called Panama papers leak. All this led to a new game plan. I decided to buy back 250 shares of Fortum for 11,60 EUR per share and 100 shares of Nordea Bank for 8,29 EUR per share. My original Fortum position was 320 shares and I’ll consider increasing my position to that or even beyond that if the renewables strategy plays out as expected. In general I wouldn’t even consider that if I wouldn’t have strong faith in the current management they have.

Recent Sell: Fortum Corporation

Today I sold 320 shares of Fortum for 11,31 EUR per share. There a couple of reasons for this. First of all Fortum won’t be producing any cash flow until Q2/2017. Secondly I anticipate that there will be a possibility to buy back the shares for less money during Q2 or Q3. This also allows me to record some losses for tax purposes and while waiting for the buyback order to go through, this will reduce the interest costs for investment debt I have for the portfolio.